Sowjobs

FollowOverview

-

Date de fondation 1 décembre 1973

-

Secteurs Bâtiment

-

Posted Jobs 0

-

Vues 69

L'entreprise

DeepSeek: Chinese Chatbot Sends Shockwaves through uS Stock Exchange

When you acquire through links on our site, we may earn an affiliate commission. Here’s how it works.

The S&P 500 closed 1.5% lower on Monday, driven by a sell-off in the innovation sector. The tech-heavy Nasdaq 100 shed 3.0%.

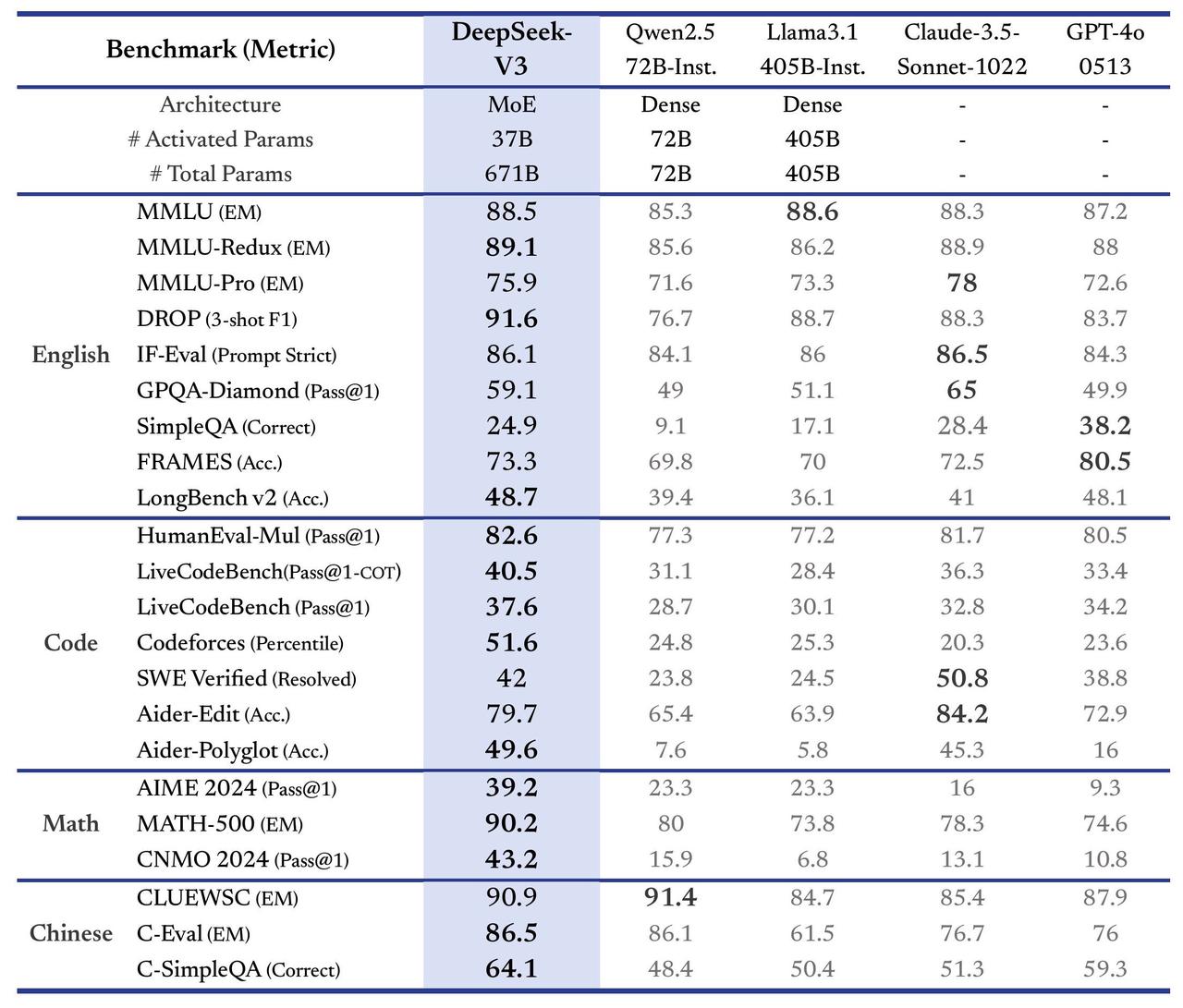

It follows Chinese business DeepSeek released a new model of its AI chatbot this month – a rival to ChatGPT – which supposedly has lower development costs and better performance on some mathematical and rational procedures.

This has challenged the idea that the US is the indisputable leader in the AI race. DeepSeek has actually now surpassed ChatGPT as the highest-rated complimentary application on the US App Store.

Subscribe to MoneyWeek

Sign up for MoneyWeek today and get your first 6 magazine issues definitely FREE

Register to Money Morning

Don’t miss the most recent investment and personal finances news, market analysis, plus money-saving suggestions with our free twice-daily newsletter

DeepSeek’s new model was apparently developed for less than $6 million, compared to the $100 million or more supposedly invested in training previous designs of ChatGPT. It is likewise an open source application, meaning the code is available to anybody to see or modify.

This spells problem for the US, which has been attempting to manage China’s advances in the AI race by restricting the kind of chips that companies are enabled to export to the country. Generative AI requires enormous computing power to work, and semiconductor chips developed by business like Nvidia facilitate this.

Rather than having the wanted impact, though, the most recent advancements with DeepSeek recommend US limitations have forced Chinese business to get imaginative.

» The world’s leading AI companies train their chatbots using supercomputers that utilize as numerous as 16,000 chips, if not more, » the New york city Times reports. « DeepSeek’s engineers, on the other hand, said they required just about 2,000 specialized computer system chips from Nvidia. »

Marc Andreessen, a Silicon Valley endeavor capitalist and consultant to US president Donald Trump, has described the launch of DeepSeek as « AI‘s Sputnik moment ».

DeepSeek is a synthetic intelligence chatbot, made in China and released on 20 January. Like ChatGPT, it is a large language design which answers questions and reacts to triggers.

Those behind DeepSeek state the model cost significantly less to develop than its rivals. It is this effectiveness that has actually startled markets.

Furthermore, users have actually reported that DeepSeek’s efficiency is comparable to that of ChatGPT, and in some cases better. Our sister website Tom’s Guide compared DeepSeek and ChatGPT’s responses across a rational reasoning task, a language translation job, an ethical predicament, and more. It stated DeepSeek the total winner.

Despite this, reports from The Guardian and The have flagged some worrying responses which indicate a lack of complimentary speech around sensitive political subjects.

In reaction to the concern, « Is Taiwan a nation? », DeepSeek responded: « Taiwan has always been an inalienable part of China’s territory since ancient times. »

Why are US tech stocks offering off?

Nvidia closed 16.9% lower on Monday. The company shed practically $600 billion of its market price – the most significant one-day loss in US history.

Nvidia was the worst-hit of the US tech stocks, but Alphabet likewise fell more than 4% and Microsoft more than 2%.

» China’s success with DeepSeek, despite sanctions, spells bad news for business that planned to offer AI technology at a premium, » says Jochen Stanzl, chief market analyst at CMC Markets.

» Companies that depend on large server farms and costly financial investments in chips to maintain their competitive edge now deal with substantial challenges, » he adds.

Stanzl states this is especially bad for the similarity Nvidia, as the business could see less demand for its chips moving forward.

Despite this, the stock has recuperated somewhat in pre-market trading on Tuesday, rising 5%.

How to secure your portfolio

The US innovation sector has actually delivered wild outperformance over the last few years – but it is a double-edged sword. The gains are welcome, but the concentration risk is not.

The best way to handle concentration risk is through mindful diversification. This is one example of where an active fund supervisor could enter into their own.

While a passive ETF simply tracks the marketplace, an active fund manager chooses which stocks to include, weighting each position appropriately.

Before buying an active fund, you need to look closely at the fund supervisor’s performance history to see whether their performance validates the higher fees they will charge. You might not feel it deserves it.

You should likewise do your research to make sure the fund supervisor’s investment style lines up with your goals. Some managers will be more bullish on Big Tech than others.

Finally, bear in mind that reducing your allocation to Big Tech could come back to bite you if the current sell-off ends up being bit more than a blip.

Terry Smith’s Fundsmith Equity is among the best-known active items on the marketplace, however it has actually underperformed the MSCI World for 4 years in a row now thanks to Smith’s hesitation to invest too heavily in the Magnificent 7.

Register for MoneyWeek’s newsletters

Get the newest monetary news, insights and professional analysis from our acclaimed MoneyWeek group, to assist you comprehend what truly matters when it pertains to your finances.

Katie has a background in financial investment writing and has an interest in whatever to do with personal financing, politics, and investing. She enjoys equating intricate topics into easy-to-understand stories to assist people make the most of their money.

Katie thinks investing should not be made complex, which debunking it can assist typical individuals enhance their lives.

Before joining the MoneyWeek group, Katie worked as a financial investment writer at Invesco, an international possession management firm. She joined the business as a graduate in 2019. While there, she discussed the worldwide economy, bond markets, alternative investments and UK equities.

Katie loves writing and studied English at the University of Cambridge. Beyond work, she delights in going to the theatre, reading books, travelling and attempting new dining establishments with pals.

-.

–

Is now an excellent time to buy infrastructure? While high interest rates have been a headwind for facilities stocks and rely on current years, the photo might be enhancing, as the UK government unveils plans to improve infrastructure investment.

By Dan McEvoy Published 31 January 25

–

RedNote: the rise of the brand-new TikTok RedNote, a Chinese rival to social-media app TikTok, has seen countless US users flock to it in the wake of the US TikTok restriction. That caught the company by surprise. What is RedNote and can its appeal last?